If You or a Loved One Has a Disability, You May Need a Special Needs Trust

A Special Needs Trust (also known as a “Supplemental Needs Trust”) serves a very specific purpose: it helps recipients of certain public benefit programs remain eligible for those programs.

Read MoreHow Often Does an Estate Plan Need to be Updated?

A question I regularly hear regarding all types of estate planning documents is “how often should this be updated?” The answer depends, of course, on the individual circumstances. However, there are some general guidelines that can be helpful. Two questions to think about regarding updating your legal documents include – have there been any major life events since the documents were last updated, and have you looked through the documents in the past 2 years?

Read MoreSnowbirds Need to Pack Something Extra Before Heading South For The Winter

Many of our clients in North Idaho and Eastern Washington are “snowbirds”. I know some clients are even headed south early this year to escape the smoky air we’ve endured lately. If you are headed somewhere warm to spend the winter months, you will want to be sure you have packed more than just your sunscreen.

Read MoreIs Court-Appointed Guardianship or Conservatorship in Your Future?

If you are an adult in Idaho and become unable to make your own decisions in life due to injury, illness, or some other form of incapacity, there are two basic ways in which another person becomes the stand-in decision maker for you. The first way is through the use of a previously written and signed Power of Attorney Document in which you will have stated who it is that should make your decisions for you if you cannot do so. That stand-in decision maker is called your “Agent” or your “Attorney in Fact.” However, if you have not previously completed valid Power of Attorney documents, a judge will need to appoint someone to become your decision maker through a court process known as Guardianship and Conservatorship. If a judge has to appoint your stand-in decision maker, that person will be called your “guardian” and/or “conservator.”

Read MoreWhich Type of Business Entity is Right for My Company?

There are many different types of business entity structures that you can utilize as a business owner, but there can be uncertainty regarding which business entity is the right one for you. Choosing the right type of business entity is an important part of ensuring that you will be able to achieve your business goals

Read MoreHow Important is Estate Planning if You Aren’t Rich?

I’m often asked if a person needs a Power of Attorney document if that person already has a Last Will and Testament (“Will”). It is a good question. The simple answer for almost everyone is yes – you should have both a Will and a Power of Attorney document. Let’s look at what purpose each serve and why both are necessary.

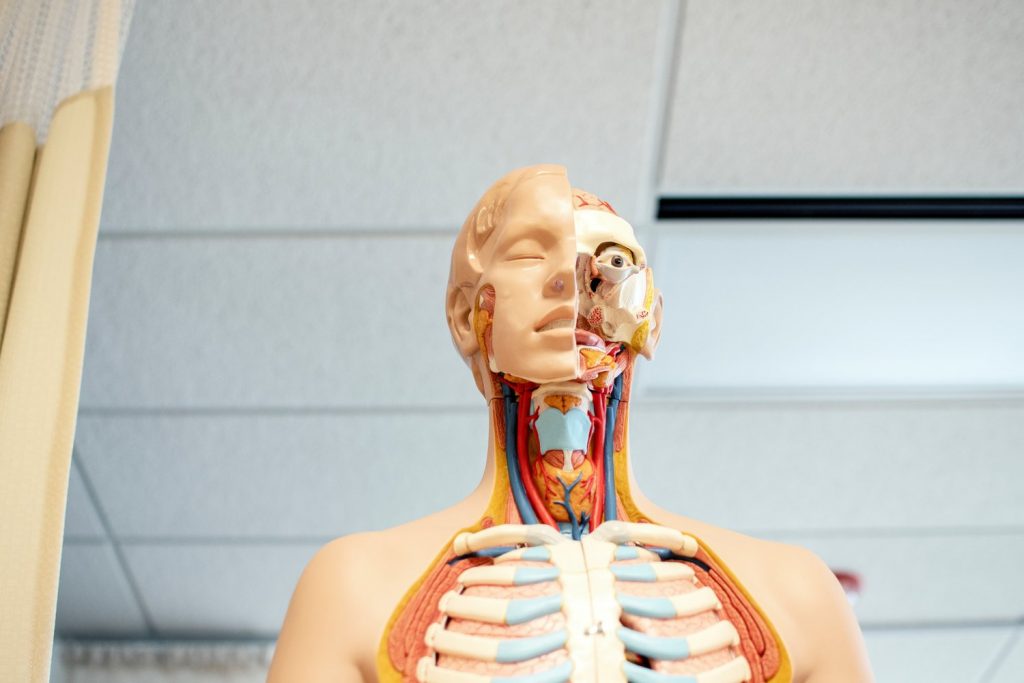

Read MoreWho Has the Final Say About Organ Donation in Idaho?

Often, clients have asked whether this authorization should be in their Last Will and Testament (“Will”). Your Will is a document that is rarely looked at by anyone other than you until after your death – and certainly your doctor or attending health care providers at a hospital are unlikely to have ever read your will.

Read MoreWHO HAS THE FINAL SAY ABOUT ORGAN DONATION IN IDAHO?

There are several things I think we should all understand about how Idaho law addresses the issue of organ donation and how we can use our estate planning documents to help make sure our wishes on this topic are followed. It is important to know that in Idaho, the law addresses organ donation from two…

Read MoreFollow These 4 Steps to Assess Your Own Estate Planning Documents

Estate planning consist primarily in putting into place those legal documents that each of us need to deal with what happens if we become incapacitated and what happens when we die. If you have estate planning documents in place and have any doubt about whether those documents are complete or up to date, the best thing you could do is bring them to an estate planning attorney to review and discuss with you. Some law firms, like mine, may do this for you without charge as a complimentary consultation. Getting an expert’s advice on the status of your documents is very valuable.

Read MoreLast Will & Testament vs. Power of Attorney Documents… and why you need both

So why do we need both documents? Simply because your Will generally has no effect until you are deceased and your Power of Attorney document generally has no effect once you are deceased.

Read More