How Important is Estate Planning if You Aren’t Rich?

I’m often asked if a person needs a Power of Attorney document if that person already has a Last Will and Testament (“Will”). It is a good question. The simple answer for almost everyone is yes – you should have both a Will and a Power of Attorney document. Let’s look at what purpose each serve and why both are necessary.

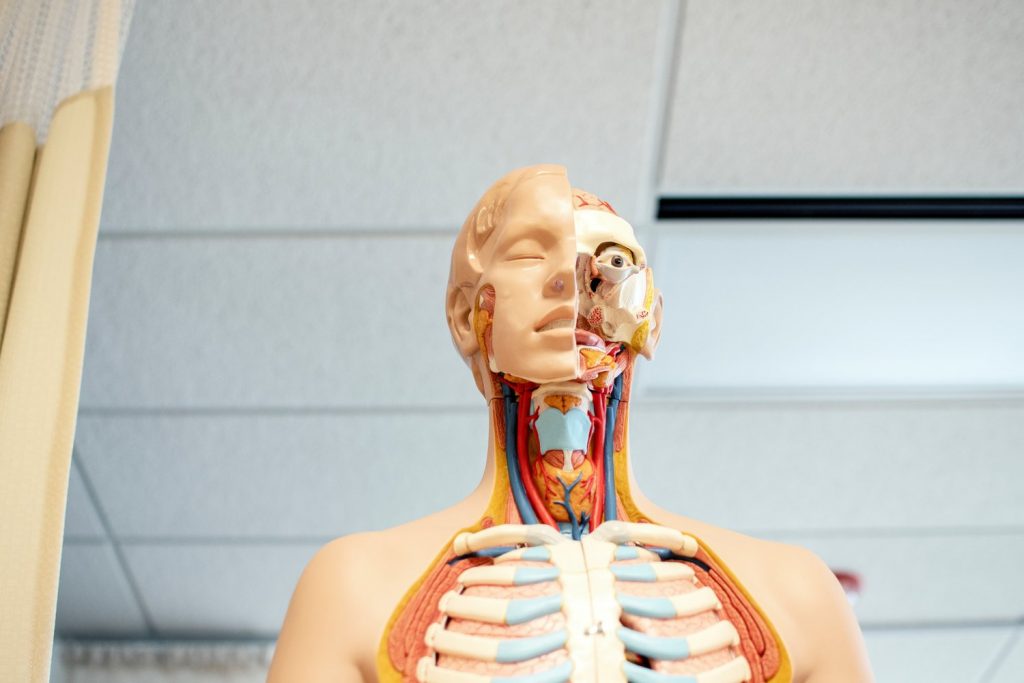

Read MoreWho Has the Final Say About Organ Donation in Idaho?

Often, clients have asked whether this authorization should be in their Last Will and Testament (“Will”). Your Will is a document that is rarely looked at by anyone other than you until after your death – and certainly your doctor or attending health care providers at a hospital are unlikely to have ever read your will.

Read MoreWHO HAS THE FINAL SAY ABOUT ORGAN DONATION IN IDAHO?

There are several things I think we should all understand about how Idaho law addresses the issue of organ donation and how we can use our estate planning documents to help make sure our wishes on this topic are followed. It is important to know that in Idaho, the law addresses organ donation from two…

Read MoreFollow These 4 Steps to Assess Your Own Estate Planning Documents

Estate planning consist primarily in putting into place those legal documents that each of us need to deal with what happens if we become incapacitated and what happens when we die. If you have estate planning documents in place and have any doubt about whether those documents are complete or up to date, the best thing you could do is bring them to an estate planning attorney to review and discuss with you. Some law firms, like mine, may do this for you without charge as a complimentary consultation. Getting an expert’s advice on the status of your documents is very valuable.

Read MoreLast Will & Testament vs. Power of Attorney Documents… and why you need both

So why do we need both documents? Simply because your Will generally has no effect until you are deceased and your Power of Attorney document generally has no effect once you are deceased.

Read MoreUncomfortable Conversations About Estate Planning (Part 2 of 2)

My clients frequently express to me how difficult it can be to speak to their family members about the decisions they have made (or are in the process of making) when we are working on their estate planning documents. Sometimes the issue is that a parent’s adult children refuse to discuss these matters because the children are not willing to acknowledge that their parent will die at some point. Other times the issue is a child that cannot get their parents to acknowledge the need to get their affairs in order. The unique dynamics that every family has can often compound the general problem of one person or the other not wanting to discuss these matters. Last week we examined the first of the two situations I’ve mentioned above. Today, let’s look at some ideas for adult children on how to motivate their parents to get estate planning in order.

Read MoreUncomfortable Conversations About Estate Planning (Part 1 of 2)

My clients frequently express to me how difficult it can be to speak to their family members about the decisions they have made (or are in the process of making) when we are working on their estate planning documents. Sometimes the issue is that a parent’s adult children refuse to discuss these matters because the children are not willing to acknowledge that their parent will die at some point. Other times the issue is a child that cannot get their parents to acknowledge the need to get their affairs in order. The unique dynamics that every family has can often compound the general problem of one person or the other not wanting to discuss these matters. Let’s start this week by looking at the first of the two situations I’ve mentioned above and consider some possible approaches to a potentially very delicate topic. Next Sunday, we will tackle Part 2 of this topic with some ideas for adult children on how to motivate their parents to get their planning in order.

Read MoreWhich Avoids Probate, A Last Will & Testament or a Revocable Living Trust?

For those who want to avoid the court-controlled process that takes place after a person’s death (known as “probate”) – using a Revocable Living Trust is typically the best way to do so. This document allows a married couple or a single individual to direct what shall happen to their assets and possessions. It will also indicate who will be in charge of carrying out those instructions, without the need for the involvement of a probate court judge.

Read MoreDo Wills and Trusts from Other States Work in Idaho?

People regularly move to Idaho from other states and bring with them wills, trusts, and power of attorney documents created in their prior state. Such people often ask me if their old estate planning documents are enforceable in Idaho. Generally, those documents are still valid in Idaho. However, there are some very important reasons to have estate planning documents from another state reviewed by an Idaho estate planning attorney. Let’s remind ourselves what each of these documents are and then consider some of the issues that create concern about out-of-state wills, trusts, and other estate planning documents.

Read MoreDo You Know What Estate Planning Documents You Need?

So many of us put off estate planning as something we will “get to soon enough”. However, national statistics indicate that approximately half of all Americans have no estate planning at all. The half of Americans that do have estate planning in place too often have very old documents, perhaps from states they no longer reside in, and even worse, those documents often do not reflect the current wishes and intentions of those Americans.

Read More